AUD/USD Bullish Traders Moving in Heavily as Diplomatic Hopes Support Risk

Bulls Smile on the Rise

As it got up to 0.7197, the AUD/USD pair has increased by 0.16% in the early Asian session as there is a sharp return of risk appetite to the market on the basis of what seem to be more signs of diplomatic efforts beaming through the wall of expectations of imminent military aggression between Russia on the one hand and Ukraine, backed by the North Atlantic Treaty Organization (NATO) on the other.

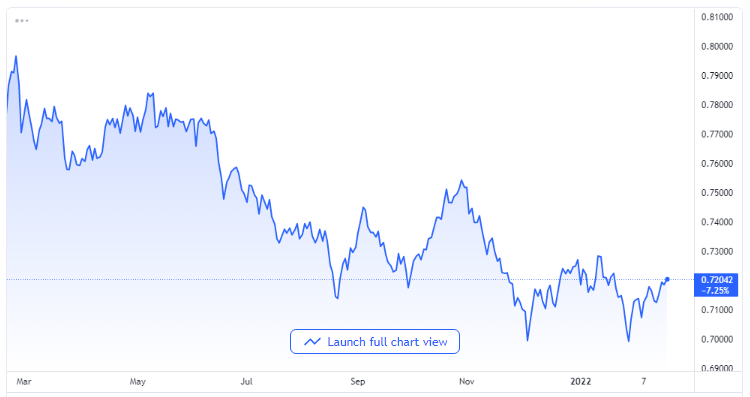

AUD/USD price chart. Source TradingView

At first, the Australian dollar had been on a very cautious path in the midst of the agitations that Russia was going to invade its neighbor as it stationed troops and ammunition at the border for weeks. News that the American Secretary of State, Antony Bliken, has agreed on a meeting with Russia’s Foreign Minister, Sergei Lavrov on the invitation of the latter, has, however, gone a long way to calm frayed nerves in Asian stock markets.

In addition, the American President, Joe Biden, is set to host a general meeting with the leaders of France, Canada, Germany, Poland, Britain, Romania, NATO, and the European Union over the situation in Ukraine on Friday.

Natural Resources React

News has it that the price of iron ore made a sharp reverse this week while China increased its effort to bring the metal under some measure of control. ANZ Bank analysts made the observation that reports of a lot of natural resources were almost at unprecedented low levels as many manufacturers focused on building up their stocks as a response to the supply interruptions that occurred in the last few years.

That measure and a combination of the predictions that there would be solid global growth in 2022 shows that resources might gain higher interest rates later on.

Meanwhile, other analysts with TD Security said that in the event that geopolitical tensions reduce, the price of aluminum would become vulnerable while the pandemic lockdown in the Chinese city of Baise comes to an end and China’s curtailing of foreign activities stops.

The analysts added further that the market’s sensitivity to the situation in Ukraine might possibly increase towards the 20th of February, which is the end of the Belarusian war games, while Western powers watch for active signs of Russia indeed sending its troops back to base as an assurance of de-escalating the crisis. On the flip side, a failure for that to happen might be a catalyst for a significant increase in Russia’s risk premium.