GBP/USD Aims for a Daily High Around 1.3625 Zones In the Midst of a Marginally Weak USD

As a leading trading pair, the GBP/USD combination retained its big tone throughout the early hours of the European session and at the time of this report, was trading close to the daily high within the 1.3620-1.3625 zones.

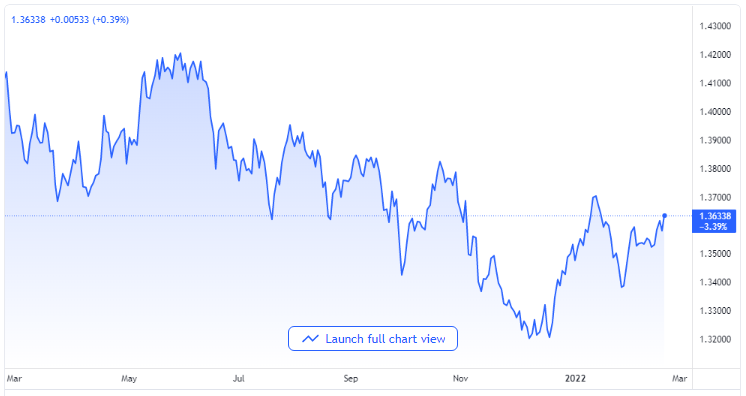

GBPUSD price chart. Source TradingView

A Gathered Strength from the Previous Week

After the pullback that occurred on Friday in the mid-1.3600s area or the monthly high, the GBP/USD pair had a new bid on Monday to set off course for the new week, and this was boosted by the renewed bias in selling US dollars. The recent rounds of optimism been spread of a diplomatic approach to end the geopolitical standoff in Ukraine has removed the general markets’ risk sentiments.

This was played out in the positive increase in the American stock futures that consequently played down the dollars’ popular status as a safe-haven asset.

Aside from that, the uncertainness attending the Federal Reserve’s monetary policy tightening program is acting as an aid to the buck. As a matter of fact, the published minutes of the Federal Open Market Committee meeting which was held on 25th-26th January did so little in terms of reinforcing expectations towards a 50 basis points interest rate increase in March.

Importantly, there are indications that the recent geopolitical events might force the Federal Reserve to take a less aggressive policy position to fight the obstinately high inflation. The evidence for this was shown in the latest pullback of the Treasury bond yields in the US, and it weighed on the USD more.

GBP Takes More Advantage

While at that, Great Britain’s pound was aided by increasing speculations that there would be more interest rate increase by the Bank of England, supported by largely upbeat macro data in the past week. That said, an absence of ways forward in the ongoing talks to find solutions to problems associated with the Northern Ireland arrangement of the Brexit settlement has held off bulls from betting aggressively on the GBP/USD trading pair. It is therefore expedient to hold on for a number of follow-through purchases before staking out for more gains.

From technical perspectives so far, the pair has struggled hard to cross over a resistance that is marked by a sliding trend line that has extended from July 2021. The stated resistance should be acting as a major pivotal point, which, if decisively cleared, could be a short-term breakout for bulls, and it could pave the way for more appreciating moves.

Market players are currently watching out for the UK’s Manufacturing and Service Purchasing Managers’ Index for near-term trading push.