GBP/USD Analysis: Monthly Resistance Inquiry Bounces Off 200-day SMA

Little Recoveries Matter

Market giant pair, GBP/USD, made a reverse on its recent losses on its way to regain the 1.3600 threshold, which is around 1.3585 leading into Thursday’s London session.

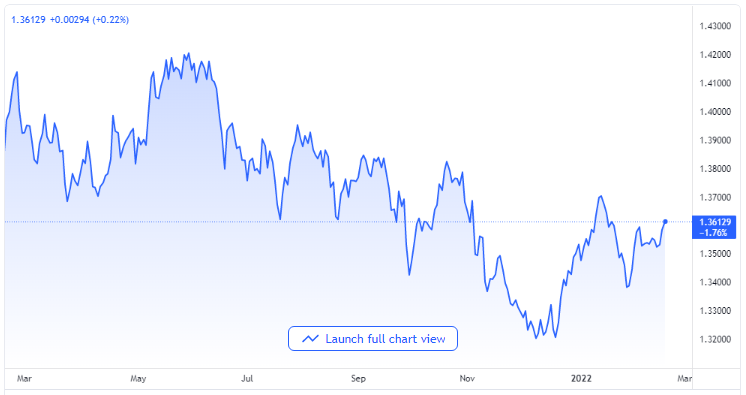

GBP/USD price chart. Source TradingView

The trading pair first dropped about 60 pips following the news of Ukrainian forces shooting mortar shells and other projectiles into Luhansk People’s Republic positions, as reported by Sputnik.

A recent convergence of the 50% Fibonacci retracement and the 200-day simple moving average of 13th-27th January downside, about 1.3550, sparked a corrective pullback on the quote, which presently aims for a downward sliding trend line since 20th January around 1.3600.

Though the bullish Moving Average Convergence Divergence indicators keep traders hopeful, 61.8% Fibonacci is an addition to the upward filter around 1.3605 to pose a challenge to further advances of the quote.

In the event of the GBP/USD pair rising beyond 1.3605, the upside line of the month’s trading range close to 1.3630 will be testing buyers.

Forecasts

In the meantime, any move in pullbacks under the 1.3550 support confluence would target 38.2% Fibonacci and a low end of the nearest range about 1.3510 and 1.3480, respectively. In the time of the GBP/USD decline beyond -1.3480, 23.6% Fibonacci zones of 1.3450 might be a tester for bearish traders before it directs them to January’s low point of 1.3357.

On Wednesday, the pair gave a lot to stretch its capacity beyond its original height where it was early in the week, and it succeeded in gaining above 1.3550 after the little gains it posted on Tuesday. It was speculated that it might be difficult for the pair to gather its needed bullish force, except there is improved market sentiment in good time.

Reports that Russia was sending back its troops to their bases on Tuesday following an end to their military exercise close to the Ukrainian border gave an opportunity to risk flows to have the upper hand in the money market. The dollar struggled to retake its position as a safe-haven commodity as GBP/USD pair gained more traction in the European session. After Tuesday’s first half of trading day, the rally declined after US President Joe Biden’s remark that Russia might still invade Ukraine.

The UK’s Ministry of Defense said, early on Wednesday, that it was yet to see any signs of Russia’s military movement away from its border with Ukraine. Ursula von der Leyen, the European Commission’s President, also said in a statement that the North Atlantic Treaty Organization (NATO) is also yet to observe any significant decline in the size of Russian troops at the Ukraine border.