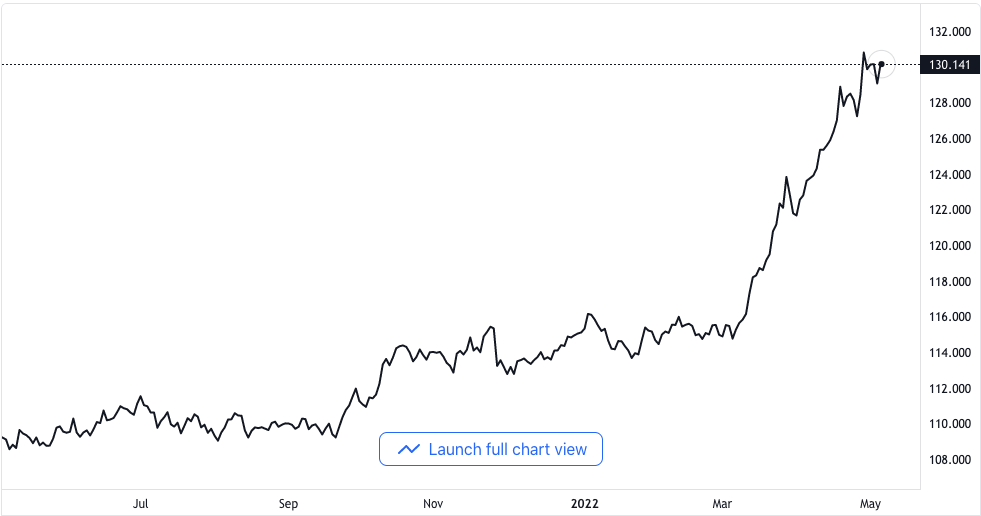

USD/JPY Hikes to New Daily High Point, Looks Forward to 130.00 in the Midst of Renewed Demand for USD

Quick Consolidation

The USD/JPY currency pair consolidated on its consistent intraday climb on Thursday. It reached a new daily height in the area of 129.75 in the course of the first half of Europe. The pair was able to draw new sets of purchases on Thursday and rallied more than 100 pips.

The latest rally of the USD/JPY pair was close to the 128.75 area. The increase made way for the price of spots to have a quick comeback from the effect of Wednesday’s decline that followed the announcement from the FOMC. The Federal Reserve had announced a 50 basis point increase in interest rates in the US on Wednesday.

USD/JPY price chart. Source TradingView

There was a comparatively good tone in the European stock markets, and it diverted funds away from the Japanese Yen as a safe-haven asset. This and the divergence in monetary policy between the Federal Reserve and the Bank of Japan gave firm support to the pair. This round of support for the USD/JPY currency pair also comes in the midst of renewed demands for the US Dollar.

The Chairman of the Federal Reserve, Jerome Powell, indicated that a more aggressive policy tightening was not likely. Although he mentioned that policymakers at the Reserve are ready to consent to just 50 basis points of rate increases at subsequent meetings. Despite that, the market continues to price in 200 basis points rate increases for the remaining part of the year.

The Market Still Expects 200 Basis Points

There are still speculations that there would be 50 basis points interest rate increases at each of the next four policy meetings of the FOMC. The evidence for this was seen in the new uptick of Treasury bonds in the US. The Treasury bond yields aided the US Dollar’s recovery from its low point of one week, which was reached in the early hours of Thursday.

Aside from the US Dollar, the US Treasury bond yields equally provided a good facelift for the USD/JPY pair. Meanwhile, the Bank of Japan has held on to its decision to go ahead with a loose monetary policy. The terms of the free policy of the Bank of Japan includes the purchase of unlimited government bonds so it could defend its ten-year yields.

The policy equally added to why safe-haven funds have drifted away from the Japanese Yen. All factors together, as stated, then became a tailwind to serve the advance of the USD/JPY currency pair. The major background favors bullish traders, and it suggests that the latest correction from a twenty-year high has finally run its full course.

Therefore, a follow-up strength, which would be over 130.00 benchmarks, is a significant likelihood. The market is now looking forward with expectations to the economic docket of the US. The docket is expected to feature the publication of the regular employment claims in the course of the North American session.

The aforementioned, as well as the US yields, are set to influence the US Dollar and its price dynamics. They would also give impetus to the USD/JPY currency pair. Traders would also be able to take near-term opportunities from the general risk sentiment.