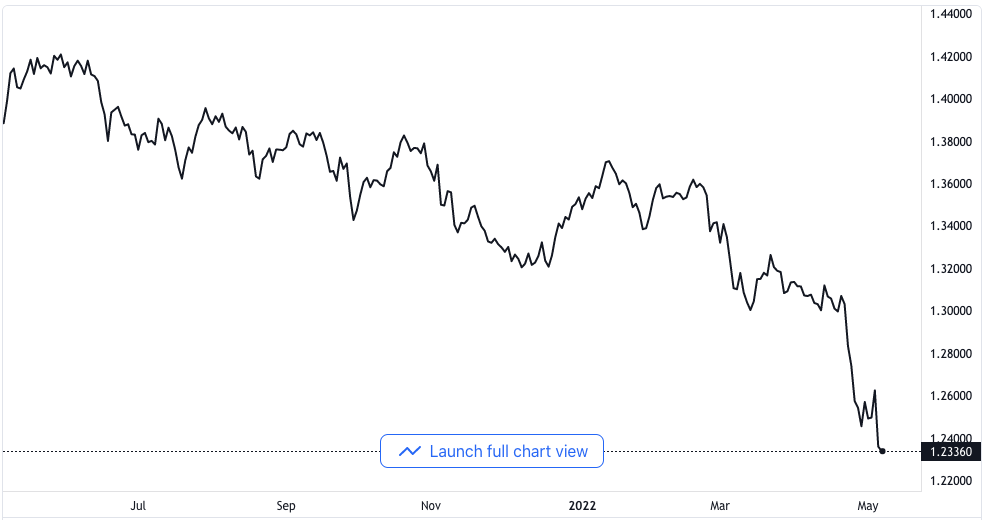

GBP/USD Goes Lower But Close to 1.2350 Area Following Upbeat NFP Report

The British Pound Sterling appears to maintain a good posture, but all is really not well as it is losing value on the day. The Pound has lost up to 0.06% following the Bank of England’s move to increase interest rates by 25 basis points. While putting this together, the GBP/USD currency pair was trading at around 1.2352.

US NFP Came in Positive, BOE Sees Inflation Reaching 10%

The global stock markets remained in their crashed state in the course of the North American session. The Treasury bond yields of the US jumped to a year-to-date high point of close to 3.131%. However, the US Dollar is surrendering some of its weekly gains, as evidenced by the loss in the US Dollar index.

GBP/USD price chart. Source TradingView

The US Dollar Index measures the currency against some other leading currencies. The Index went down by 0.18% to sit at 103.370.

The Nonfarm Payroll data for the month of April got published by the Department of Labor. The figures show that up to 428,000 jobs were added to the economy. The new job figures came higher than the 391,000 that was the forecast for it.

Despite the goodish report from the Nonfarm Payroll, the Depart of Labor said the Unemployment rate was unchanged, cutting back the excitement of job creation. The average hourly earnings increased by 5.5%, which was just a bit under what was expected of it. The latest data publications would not stop the Federal Reserve from going ahead with its monetary policies as planned.

Financial analysts with ING considered the released data to be of mixed values. They said via a client’s note that the rate of unemployment was steady at 3.6% against falling to 3.5%, which was in expectation. When compared with the average hourly earnings of 0.3% month-on-month, it might be seen as a sign of less pressure of inflation on the jobs market.

In Europe, the Bank of England’s Chief Economist, Huw Pill, said that the UK’s inflation is becoming too persistent. He noted that the inflation rate is rising to 10%, while there is an expectation of stagnation in Q2. He made this known during the Mid-European session.

The United Kingdom’s economic docket is going to show the GDP for the month of March next week. The data from the Balance of Trade, as well as the Manufacturing Production report, will also be there.

A barrage of speeches from top officials of the Federal Reserve is expected to dominate news headlines next week. The market would also expect the publication of the Producer Price Index and Consumer Price Index for the month of April.

GBP/USD Technical Perspective

The pair is still down due to market bias. However, there is a strong line of support for it at the low level of June 2020 at 1.2251. The MACD is currently forming a divergence that usually signals that there might be a shift in trends.

But then, except the MACD signal line goes over, traders of the GBP/USD pair should stay away from staking new long-term bets on the currency pair.