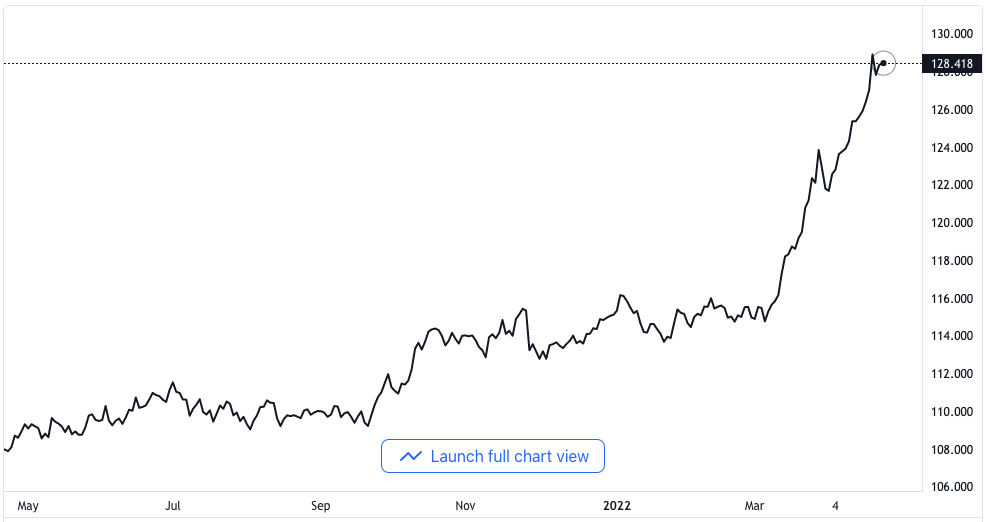

USD/JPY Bullish Traders Pull Out of Resistance Zone Close to 128.60

Firmer Monetary Policies, Anyway

The USD/JPY currency pair is trading higher by about 0.17% to be at 128.59, and it has gone between the ranges of 128.26 low and 128.69 high. The pair got some level of support from the US bond yields that rose sharply overnight on the back of the speech of the Federal Reserve’s Chairman, Jerome Powell, where he indicated in Washing DC that there is going to be a firmer policy. Powell spoke at the spring meeting of the International Monetary Funds and the World bank.

USD/JPY price chart. Source TradingView

Powell gave signs during the meeting that an interest rate of 50 basis points is well on the table for the Reserve’s meeting in May. He equally mentioned that it was just the right thing to do for policies to be implemented at a rapid rate and face it frontally. The Reserve Chairman did not, however, say more on the policy implementation other than that.

Consequently, analysts with Nomura have started to predict that the Federal Reserve will go ahead to raise its interest rates by as much as 75 basis points during their other meetings to come up in June and then July. Following an increment by 50 basis points in May, it is set to boost the Federal Funds up to a 2.25% to 2.5% range towards the end of July.

USD Rally

There was another rally in the bond yield of the US, and the curve flattened following the speech from Powell that indicated the possibility of a 50 basis points increase at the next Federal Open Market Committee meeting. There was a rise in the two-year bond yield from about 2.57% to about 2.68%, and that of the ten-year yield rose from 2.82% over to 2.91%

As far as data is concerned, the weekly unemployment claims came in close to what was expected at 184,000. The estimated figure was 180,000. Meanwhile, there was an underperformance of expectations by the continuing claim, which came in at 1.417 against the 1.459m that was estimated. Nevertheless, the manufacturing index from the Philadelphia Federal Reserve also came in relatively weaker than was estimated. It dropped to 17.6 points in the month of April all the way from 27.4 points in the month of March.

As for the Japanese Yen, Finance Minister Shunichi Suzuki stated that he had a communication with the US Treasury Secretary, Yellen, over the need for closer engagements between the two countries for their foreign exchanges.