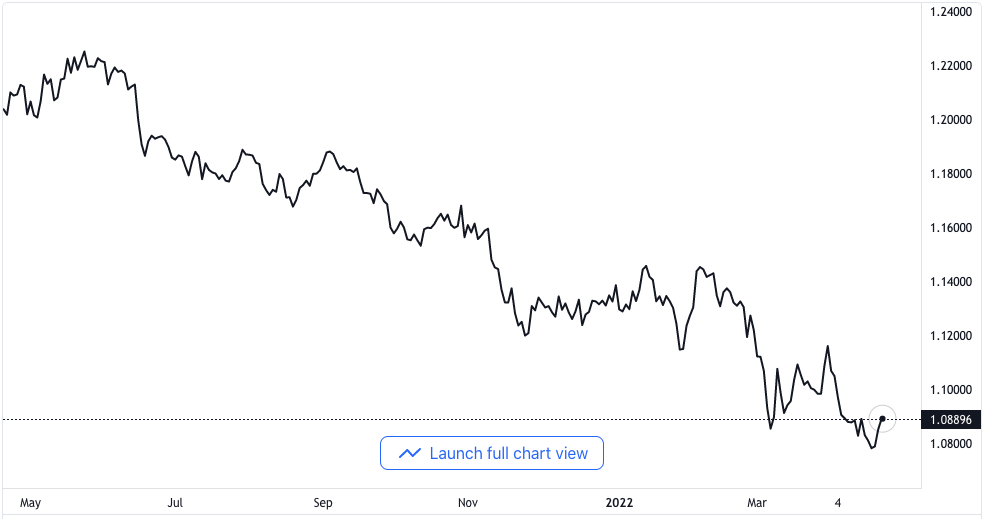

EUR/USD Recovers Above 1.0840 With Uncertainty in the US Dollar Index Ahead of Lagarde and Powell Speeches

Narrow Path of Movement

The Euro and US dollar currency pair is seeing a trend of double distribution in Thursday’s session in the midst of the cautious mood that enveloped the market after the consumer confidence and central consumer price indexes were published in the Eurozone. The currency pair showed a narrow style of movement in the early hours of trade in Tokyo before it had a downturn to1.0824. Although it is possible, it balances in a short while.

EUR/USD price chart. Source TradingView

The Eurozone’s economy is contending with a number of headwinds that come principally in the form of the increased cost of energy following the beginning of the war in Ukraine. Europe is one of the top victims of the war in Ukraine and the sanctions against Russia as it sources more than 25% of the energy it requires as well as more than 30% of the oil it needs from Russia.

There are general fears that the regional economy might likely fall into a stagnant inflation session as a result of the high and prolonged inflation, which has brought about a static growth rate. As the market looks forward to an address from the European Central Bank’s President, Christine Lagarde, it is speculated that there will be an indication of the direction of the impending monetary policy of the bank set to be announced soon.

Low Consumer Confidence in the Euro

Meanwhile, investors are bracing up for more decline in consumer confidence in the Euro. It is expected that the confidence catalyst will be released at about -20 as against the initial figure, which came in at -18.7. It might then cause some downward pressure to be exerted on the Euro, while the annual central consumer price index is speculated to come in at 3%, just like the initial print at the same 3%.

In the United States, on the other hand, the US dollar index has fallen following the print of n intraday high point at 100.59. It is possible that the dollar index shows some sporadic movements in the European session as investors await the address coming from the Federal Reserve’s Chair, Jerome Powell, as it is scheduled for the New York session. It is expected that insights gained from Powell’s speech are going to have more impact as it is possible to be the final speech of the Reserve’s Chair before the next announcement of an interest rate in the month of May.