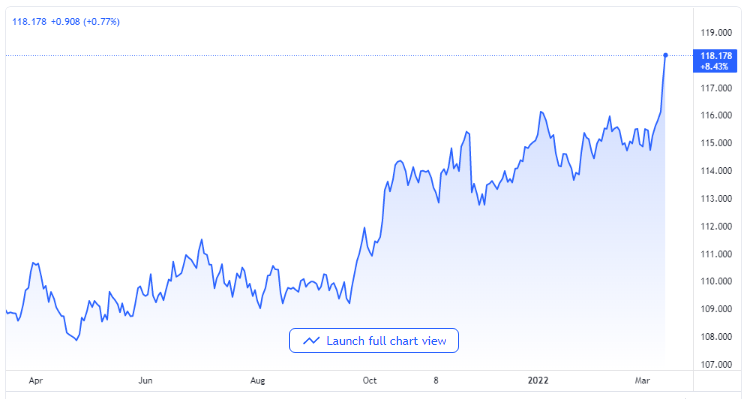

USD/JPY Hits New Multiple Year Height Over 118.00

Pair Rally Influences Bonds

The USD/JPY currency pair rose over 118.00 levels on Monday since it had fallen below it in January 2017. At the time of this report, the pair was effectively trading at 118.15, steadily rising by 0.6% every day.

The sudden upward surge that was seen in the US Treasury bond yield looks to have been triggering the USD/JPY rallies at the start of the week. The ten-year US Treasury bond yield, which has a benchmark, rose by 15% in the past week, and it was last seen having gains of more than 4.0% on Monday at 2.09%.

USD/JPY price chart. Source TradingView

In the meantime, all positive dispositions that have been observed in the market’s risk sentiments have helped the USD/JPY pair retain its bullish run in spite of the average pressure to sell that is going on around the US dollar.

All market players are being hopeful over the possibility of the political crisis in Eastern Europe easing out with a diplomatic approach as Russia and Ukraine have been engaged in several rounds of peace negotiations. A Ukrainian Presidential advisor was quoted to have said on Monday that the next stage of talks with Russia will be how to achieve a ceasefire, Russian troop withdrawal as well as a security guarantee in order to ensure lasting peace.

Diplomatic Bright Lights

Diplomats from both sides of the war sounded convincingly hopeful over the weekend about the possibility of reaching reasonable agreements in the coming days. In a reflection of the market’s ecstatic mood, the US equity index futures went up as high as between 0.9% and 1.2%.

Japan leads when it comes to importation, and the leading Asian economy is importing various items at expensive exchange rates to the US dollar, a situation that is forcing lots of investors to drop the yen in favor of other safe-haven assets. Note that Japan ranks as the number five consumer of crude oil on the global index. The rapidly increasing outflow in the country’s revenue might pose a dangerous threat of deeper fiscal deficits in the Japanese economy in the coming days.

The US dollar got to a five-year high against the Japanese yen in overnight trading at 117.88 as investors placed bets that the Bank of Japan, which is scheduled to meet on Friday, would continue having a dovish position in spite of increasing inflation pressures.

Strategists at ING FX wrote in their client note that the USD/JPY currency pair is continuing to get higher as it is aided by the twin factors of the US bond yield and the imbalance in Japan’s trade created by the rise in crude oil prices.

The British pound, on the other hand, was struggling at a 16-months low point as it traded flat at $1.30415, while Thursday’s Bank of England’s meeting is in view.