Stocks And Bond Yields Fall On US China Tensions

On Tuesday, stocks saw a slide, and bond yields fell over worries that relations between the United States and China would suffer due to a scheduled visit to Taiwan by US House of Representative Speaker, Nancy Pelosi.

Safe-asset demand

The demand for safer assets went up amongst investors after China threatened the consequences of the Pelosi visit to the self-ruled island, which it considers its own territory.

There was a decline in bond yields in the euro zone and 10-year US government bond yields also fell to a low of four months.

The Japanese yen was on course to gain for the fifth consecutive trading session against the greenback. The latter also rose against a basket of major currencies.

However, there was a fall in crude oil, as investors were concerned about a downturn in global manufacturing.

There was a 0.5% drop in the MSCI world equity index that tracks shares in about 47 countries. There was a 1% loss in the European STOXX 600 index, which intensified losses in early morning trading.

Futures gauges indicated that there would be a 0.8% drop in Wall Street stock indexes.

Taiwan visit

According to a source, Pelosi was scheduled for arrival in Taipei later in the day and a number of Chinese warplanes were flying near the median line that divides the Taiwan Strait.

After repeated warnings from China about the Taiwanese visit, Washington responded on Monday that China could not use intimidation to stop the visit.

Market analysts said that the visit had changed the geopolitical agenda. The issue only added to a sense of unease that had been seen on Monday in markets after the weak manufacturing data in Europe, the US, and China.

All three regions saw their manufacturing activity drop, with the United States seeing a decline to its lowest since August 2020.

The 10-year US government bond yields were down to 2.52%, thanks to bets that the US Fed could slow down its monetary policy tightening amidst an economic slowdown.

Recession worries

There was a 4.5 basis points decline in German government bond yields to 0.72%, after falling to their lowest since April.

This decline comes as investors scaled back bets of further rate hikes from the European Central Bank (EBC) due to recession worries.

There was a decline in Brent futures to $99.14 per barrel, in addition to an overnight decline of $4. Likewise, the $5 slide in US West Texas Intermediate futures extended, as they came down to $92.94.

A 1.3% fall was seen in the MSCI’s index of shares in Asia-pacific, while a 1.6% drop was also seen in the Taiwanese stock index.

A 2% decline occurred in Chinese blue chips and currency markets also saw a move toward safety.

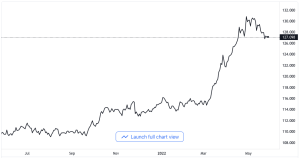

The US dollar declined against the Japanese yen to 130.40, which had not happened in two months. It was last recorded at 0.5% lower for the day.

But, the US dollar index was up by 0.3%, which measures the greenback against its major peers, to reach 105.62.