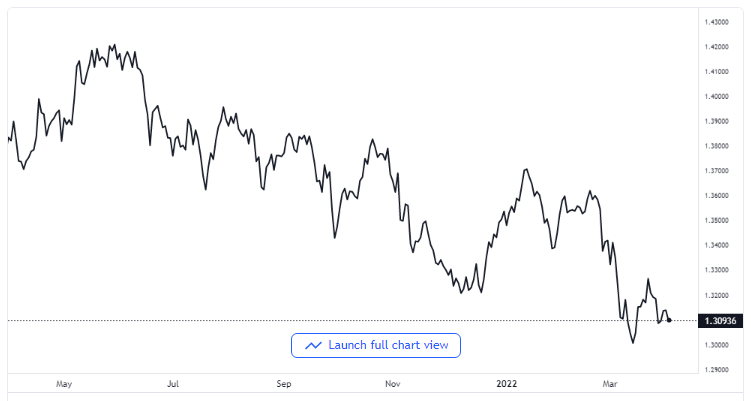

GBP/USD Renews Daily Low Point After Non-farm Payroll Release, Bears Hover Around 1.3100 Levels as US Dollar Strengthens

Non-farm Payroll is Out!

The GBP/USD trading pair saw a level of sales in the course of the early session of trade in North America and it fell to a new daily low point, nearer to the 1.3100 benchmarks after the publication of the American jobs data.

The published Non-farm payroll reveals that the American economy created an additional 430,000 jobs in the month of March, which was significantly less than the expected 490,000. The disappointing figures were, however, dominantly overtaken by a revision upward in the reading of the previous month to reach 750,000, moving away from 678,000 which was published earlier.

GBP/USD price chart. Source TradingView

Importantly, the US jobless rate dropped to a relatively low 3.6% away from the initial 3.8%. In another reported data, the hourly average earnings increased by 0.4% month-on-month in contrast to the 0.1% upward revision which was reported in the month of February.

The Non-farm payroll report didn’t have so much surprise that the details of it further proved the market’s speculations that the Federal Reserve would increase interest rates by up to 100 basis points in the course of its two next monetary policy meetings which the first is scheduled for the month of May.

The report and what it proves boosted the American Treasury bond yields and it continues to underpin the US dollar as a safe haven commodity, which goes to put some pressure on the currency pair of GBP/USD. Taking that into account, a risk-on mood served to cap the pair and prolonged some measure of support for it.

So far now, bullish traders have tried to defend the round figure benchmark at 1.3100 and it is now expected to serve as a pivotal point. It is going to take a strong break under to expose the weekly low points in the vicinity of mid-1.3000 zones. If there are subsequent follow-up sales, they would bring some vulnerability to the GBP/USD pair and it would hasten its fall to the year-to-date low point which is close to the 1.3000 psychological benchmarks.

All Focus On Russia and Ukraine Now

With the major report expected this week already checked, all attention now turns to the crisis in Eastern Europe between Russia and Ukraine. The market maintains optimism over the success of diplomatic efforts through several peace talks. The evidence of this optimism came from the increased tractions in the stock market. Therefore, geopolitical news will continue to influence risk appetites in the market.