GBP/USD Recovery Fights the 1.2530 Barrier as the US Dollar Pullback on All Fronts; Fed-BOE Decisions Expected

Anticipating Meeting Decisions

The GBP/USD currency pair was on the track of most other currencies as it printed average gains against the US Dollar in the early hours of Tuesday as the market opened in Europe.

More so, they caution that has taken over market activities as the wait begins for decisions of central banks from their meetings and coming holidays in Japan, and China has created a challenge for buyers of the cable pair over close barriers in the vicinity of 1.2530 at least.

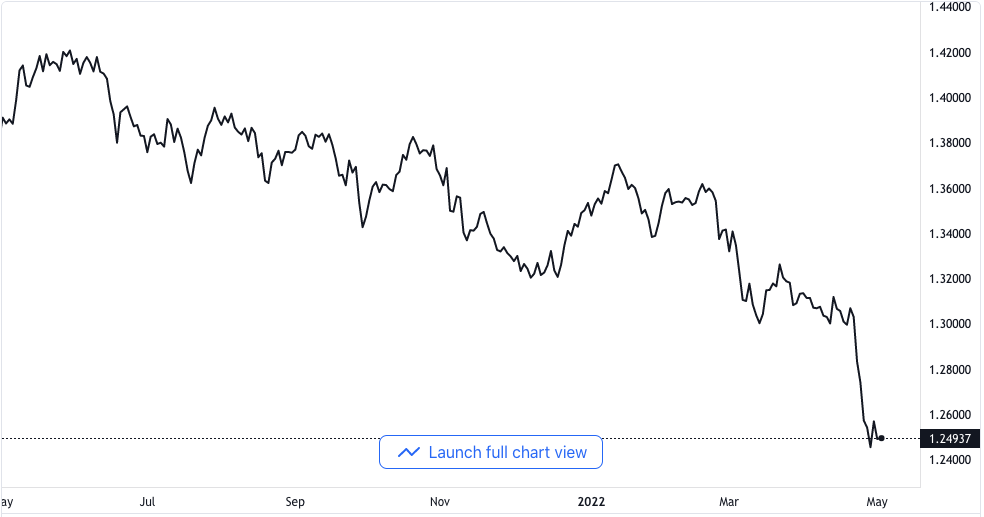

GBP/USD price chart. TradingView

For the US Dollar index, it dropped by 0.13% to 103.47 to become an off sale in Japan and it resulted in an auction and went into Asia’s bond market. That move has left the benchmark of the Treasury bond yield unaltered. Given the pullback of the ten-year US Treasury bond yield from its highest price point since 2018 as of the close of business on Monday, after it renewed to a high point of many days.

Traders of the US Dollar took over the market, which seems to have been dormant, to be an opportunity to shed their latest gains.

Another factor that is very likely to have put some weight on the price of the US Dollar index might be associated with the latest ease in various US reports. The ISM Manufacturing Purchasing Managers’ Index for the month of April dropped to 55.4 against the market speculation of 57.6 and the prior figure of 57.1.

The S&P Manufacturing Purchasing Managers’ Index equally eased to 59.2 away from the expected 59.7 figure, which was also the last reading from it.

Furthermore, the hope that there would be a 50 basis points increase in interest rates from the US Federal Reserve and the challenges over the economy confronting policymakers in the United Kingdom, which includes situations around Brexit and more economic fallouts from the war in Ukraine, have all kept sellers of the GBP/USD pair very hopeful.

Brexit and Attendant Issues

The issue of Brexit has been a point of serious pain to policymakers in the UK, and the recent deadlock in negotiations has caused the inability of British expatriates in Spain not been able to drive as they have all been slammed with a driving ban.

Whereas in Germany, the government has gone back on its previous call to ban oil importation from Russia. That decision, some fear, could further fuel the political tensions around Ukraine and then underpin the US Dollar as a safe-haven commodity.

Another factor that favors safe-haven assets is the strict lockdown measures in China as a result of COVID.

After noting the aforementioned, the recovery of the GBP/USD currency pair is quite doubtful till the policy meetings of the US Federal Reserve and the Bank of England have been concluded, and their resolutions announced.

The Factory Orders for the month of March in the US that are expected to come in at 1.1% against the prior figure of -0.5% are going to keep the market busy in the meantime.