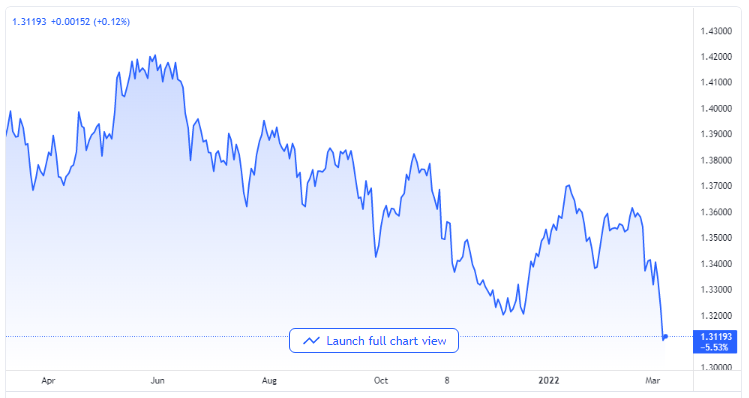

GBP/USD Recovers from Under 1.3100 Points, Its Lowest Points Since November 2020

Speedy Recoveries When They Matter

There was an early reversal for the GBP/USD trading pair from a dip encountered in the first session of the European session. The drop went below 1.3100 levels which is the lowest since November 2020, but it later hiked back to the day’s high about an hour before putting this piece together. The pair got to trade in the 1.3125 zones, close to 0.20% on the day.

GBP/USD price chart. Source TradingView

A shift in the global risk sentiments, as mirrored by the excellent recovery in the global stocks market, inspired a level of profit-taking in the vicinity of the safe-haven US dollar. It became taken as the main factor that stretched a level of support towards the GBP/USD pair and also at the base of a sharp increase in the last couple of hours of trading.

Aside from this, speculations that the Bank of England might go ahead with its plan to increase interest rates during its meeting this March also added its quota in benefitting the British pound and supported it.

That said, all positive movements still look elusive as there are further escalations in the ongoing war between Russia and Ukraine. There are reports that Russian jets have been dropping bombs around Kyiv while the third round of meeting to help get a ceasefire ended without resolutions. Furthermore, fears of significant inflation on the global economy across various sectors are expected to put a lid on optimistic moves in the financial markets, and it could continue to underpin the US dollar’s safe-haven and global reserve status.

Commodity Prices are Soaring

Against the background of concerns about the implications of an economic fallout resulting from the Russian war in Ukraine, the latest considerable gains in the price of commodities have consequently increased the risk of stagnant inflation. This went ahead to instigate a sharp increase in the American Treasury bond yield, which also supports the possibility of the emergence of new US dollar purchases at low levels.

It will be, therefore, prudent to hold on for necessary follow-up purchases before traders begin positioning for more gains around the GBP/USD trading pair.

While there are no major market-influencing economic publications expected from either the United States or the United Kingdoms, the market’s focus will be fixed on new events around the conflict and attempts at resolutions in Eastern Europe. The wider market risk sentiments and the American bond yield are expected to be of influence on the US dollar and its attendant dynamics.