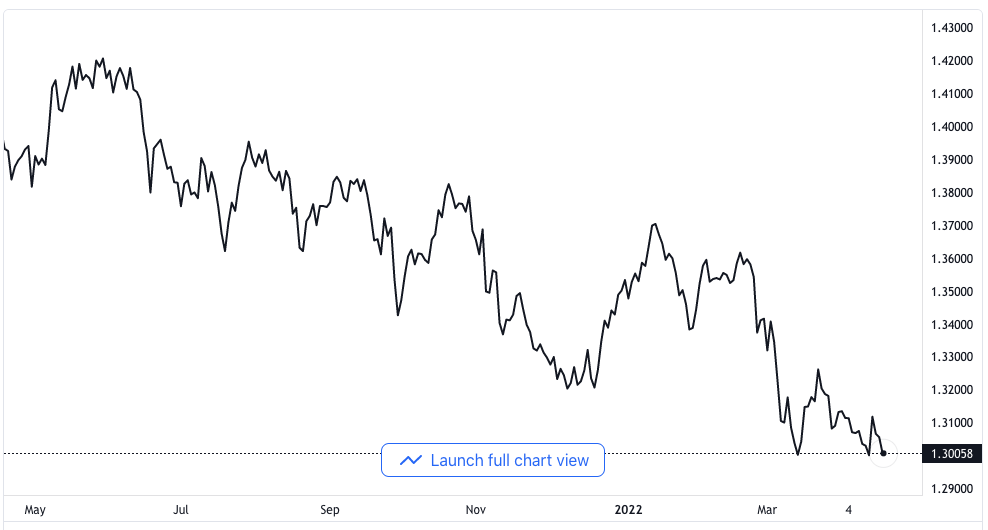

GBP/USD Hovers Around Daily Low Close to 1.3000 Benchmarks in the Midst of General Strength of the US Dollar

New Upticks

The GBP/USD pair continued on its falling trajectory in its continuous intraday decline and fell further to a new daily low point in the vicinity of 1.3000 psychological benchmarks in the first part of the European session.

GBP/USD price chart. Source TradingView

After the currency pair was lucky to have begun with an uptick towards the 1.3065 zones, it later met headlong with a new set of supply on Monday and consequently stepped backward, close to the year-to-date low point it had reached in the past week. This becomes the third day in a row where there will be a negative movement which was supported by a continuous purchase of the US dollar, boosted by eager expectations that there would be a stricter monetary policy implementation by the US Federal Reserve.

The market’s conviction that the Federal Reserve would apply more momentum in its interest rate increment to fight the escalating inflation keeps getting stronger by the day. The latest affirmation of the market’s bet came from the hawkish comments of the Federal Reserve President of New York, John Williams, on Thursday. The statement was taken as a direct signal that even hitherto cautious and somewhat dovish policymakers are already in tune to have the higher interest rates implemented.

Increased Commodity Prices and Inflation

This reality, as well as the general worries about the continued war between Russia and Ukraine, with fears that it would continue to add more pressure on the price of commodities and the exploding inflation rates, also keeps giving support to the US Treasury bond yield. Aside from all these, the general good mood in the market gave more support to safe-haven assets and applied some downward pressure upon the GBP/USD pair.

Having that in mind, the relatively lean condition of liquidity as there was a public holiday throughout Europe was expected to help in limiting the adverse effect of the GBP/USD currency pair as there are no significant market-moving events or data up for publication in the United States. However, market bias seems to be in favor of bearish traders, and it supports the possibility of a further short-term move of depreciation.

The strength of the US dollar index also bears heavily on the pair as the Treasury bond yield rise. The recent dovish tone coming from officials of the Bank of England helped to tame market agitations for a couple of weeks now.