GBP/USD Correction of 100 pip Stalls as Russia-Ukrainian War Continues

The GBP/USD trading pair persists under pressure at the beginning of the new week as it went under by up to 0.44% at the time of putting this together. The current price is, nevertheless, away from the low points that were printed after an opening lacuna of more than 100 pips to be at 1.3307. The theme of most US Futures is in the risk-off, and Asian stock prices are in a sea of red arrows as the crisis in Eastern Europe escalates.

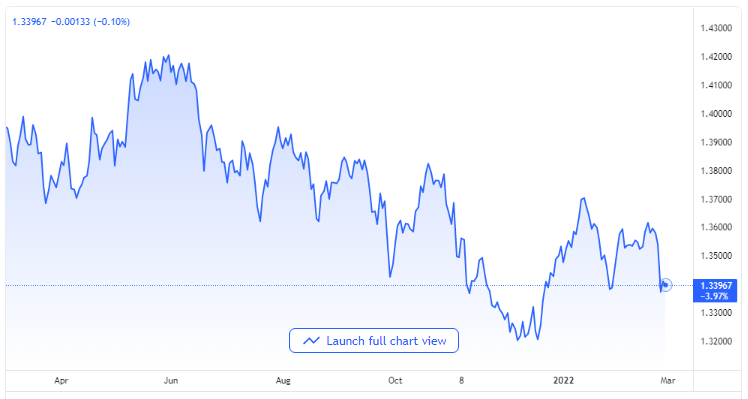

GBP/USD price chart. Source TradingView

Nuclear Threats

Russia’s President’s statement that leading NATO officials are making more aggressive statements against Russia, which led him to give an order for nuclear readiness, has further weighed o market sentiment. The news about NATO’s aggression was reported by Russia’s state news media, TASS.

Western countries have imposed more stringent sanctions on Russia over the weekend for its invasion of Ukraine. NATO blocked the access of some Russian banks to the SWIFT international payment platform on Saturday in further moves of punishment for Russia’s military campaign against Ukraine.

More Diplomacy in View between Ukraine and Russia

The international financial market is currently waiting and anticipating the possibility of a peace talk between the two warring sides. Political analysts say that could take place anytime from Monday. The Turkish President, Recep Tayyip Erdogan, has already offered to mediate a peace talk between both nations as Turkey has a good relationship with both Russia and Ukraine.

In the meantime, there are expected to be more statements from central banks this week. The Bank of England’s officials, Mann, Saunders, Cunliffe, and Tenryro, are expected to make public statements. The Bank of England’s policy maker Mann had in the past week mentioned that it was the high inflation expectation that occasioned his vote for a 50 bps interest rate increment early in the month.

Governor Andrew Bailey of the Bank of England had told lawmakers that he foresaw risk indicators that inflation might actually overshoot what they had earlier forecasted. He, however, asked investors not to be carried away over the possible degree of interest rate hikes. Investors have started to price in another 25 bps rate hike for when the central bank meets next on the 17th of March, with a new hike completely priced in at the following meeting later in May.

Early in the past week, the GBP/USD trading pair consolidated on its intraday losses around the 1.3600 zones when it picked up fresh bids with traders of the cable patiently waiting for the London open on Tuesday.