GBP/USD Bullish Traders Maintain Control as Pair falls Beneath 1.2500, US Dollar Continues Rally

Extended Bullish Run

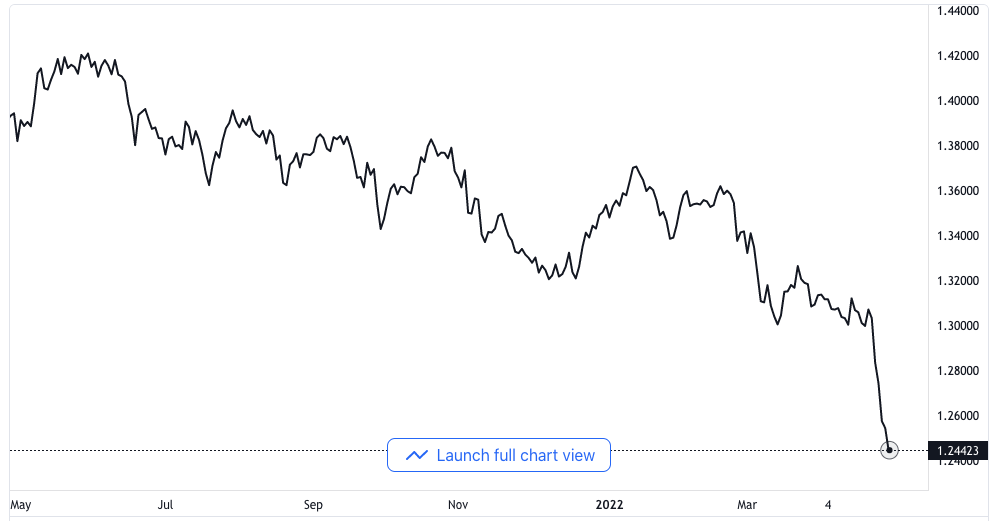

Following some early signs of what seemed to be stability on Wednesday, bullish traders of the GBP/USD currency pair gained full control again on Thursday, and they have now shoved the pair under the 1.2500 line for the first time since it was last at that level in June 2020. At the present level of around 1.2470, the currency pair trades with some losses of just above 0.5% on daily trade levels as it is on its way to posting a loss of six days in a row during the course of which it fell by more than 4.5% from about 1.3100.

GBP/USD price chart. Source TradingView

The US dollar, on its part, has continued to gain more strength on all fronts in the midst of several factors that heighten the demand for safe-haven commodities among fiat currencies. The demand for bond yields from the Federal Reserve also contributes to the US dollar’s strength as the Federal Reserve is expected to increase interest rates at a faster pace in its coming meeting in comparison to most of the Reserve’s counterparts in the G10.

The comparison includes decisions of the Bank of England, which has been set to increase its interest rates by 25 basis points next week, even though financial analysts have sent a warning that such a move might indicate a decrease in the momentum of the interest rates scheduled for days ahead. There are growing concerns over the United Kingdom’s economy’s health.

All Indicators Show High Cost of Living

The latest rounds of reports with regards to the retail sales report for the month of March and the Distributive Trades Survey for April all suggest that the ongoing high cost of living, which is the worst to hit the United Kingdom in decades, is applying so much pressure on consumption.

Apart from the strength of the US dollar, the increasing pessimism about the United Kingdom’s monetary policy and economic outlook has become the major catalyst for the pullback of the GBP/USD currency pair.

Technical analysts have warned that the latest movement observed about the pair seems quite overstretched, and there might be an average positioning soon, which is a pullback in the rapidly advancing US dollar. However, the possibility of having a long-last recovery in the GBP/USD currency pair does not look realistic for now.

For now, market players will be watching out for the publication of the US Quarter One GDP and the unemployment claims report.