EUR/USD Dribbling Close to 1.0900 as Bond Yields Rally on Federal Reserve vs. ECB Clamors

A Pair Struggling in Leadership

The EUR/USD currency pair is struggling hard to get clear directions while the battle between the European Central Bank and the United States Federal Reserve intensifies. Another factor challenging the market-leading pair and its traders are mixed feelings over the raging conflict between Russia and Ukraine, as well as new COVID cases emerging in China.

That being noted, the quote picked up new bids of late to 1.0915 as it led into the European session on Monday.

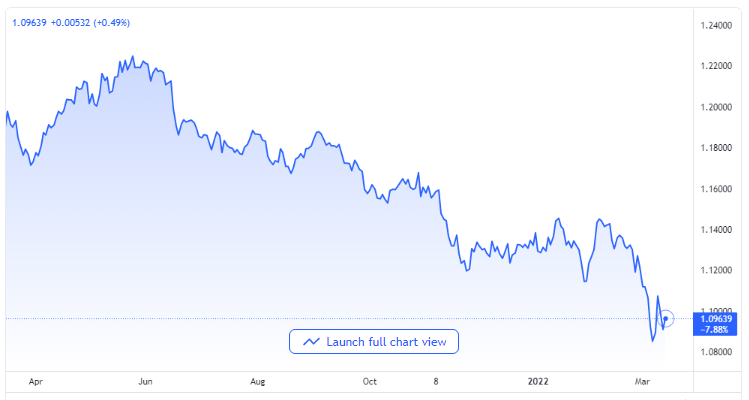

EUR/USD price chart. Source TradingView

The European Central Bank, though, gave clues to the coming interest rate increase after the latest tapering escalation; the Governor of the French Central Bank, Francois Villeroy de Galhau, said that there is nothing as an automatism between ending the bond-buying policy and higher interest rates.

On another hand, the United States’ five-year Treasury bond yield had an all-time renewal of over 2.0% in the midst of high inflation speculations, as weighed in the ten-year break-even inflation rates with regards to the St. Louis Federal Reserve reports.

More Strength for the US Dollar as Crisis Intensify

Meanwhile, the US dollar index is tracking stronger yields upward while it prints a three-day increase in the vicinity of 99.16. The market has been unable to verify the positive status of the peace talk between Russia and Ukraine is also boosting the US dollar as investors resort to it as a safe-haven asset. The sudden surge in China’s COVID cases to pandemic level also fuels the US dollar increase value.

It should be noted that reduced prints in Michigan Consumer Sentiments for the month of March which went down by 3.1 points to arrive at 59.7, are testing bulls of the US dollar ahead of the coming European session.

As things move on, players in the market are expected to keep their eyes fixed on the major Federal Open Market Committee meeting and reports scheduled to hold on Wednesday. As for the most recent reading from the Chicago Mercantile Exchange’s FedWatch, there are up to 94% possibilities that the Federal Reserve will go ahead to announce a 50 basis points interest rate increase, which in turn will keep the EUR/USD currency pair sellers more hopeful.

Aside from the Federal Reserve linked chatters in the market, the grim news from Ukraine and the worsening virus condition in China might equally weigh heavily on the EUR/USD pair prices. However, key reports and events on Monday could come up and fix some concerns over the Russia and Ukraine ceasefire deal.