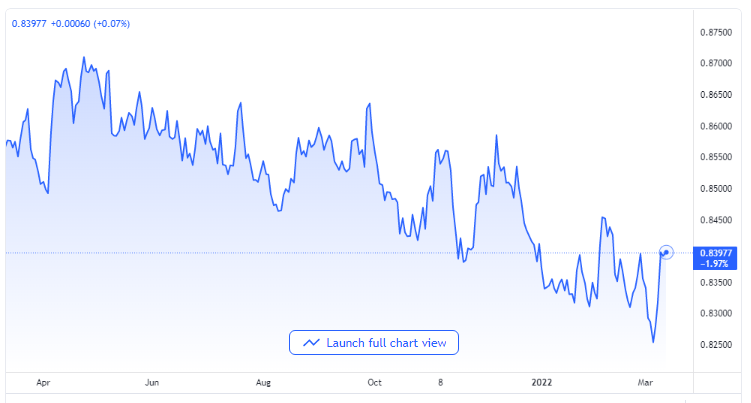

EUR/GBP Regains 0.8400 In Spite the ECB Postponement of Its Interest Rate Increase and Geopolitical Crisis

ECB Might Be Posing Challenges, But With Limited Choices

The EUR/GBP currency pair is beginning to gain higher in spite of the barriers of the status quo the European Central Bank has decided to maintain after its Thursday meeting. It does this also in spite of the failure of the Russia-Ukraine peace negotiation in Ankara, Turkey, to have a positive outcome.

The result of the European Central Bank’s monetary policy meeting that was held on Thursday was that the interest rate increase got postponed till the halting of its bond-buying program of the European Central Bank, which might happen by the end of the third quarter of 2022.

EUR/GBP price chart. Source TradingView

Along with the increasing inflation rates, the European Central Bank has to find a solution to the multiple effects of the war between Russia and Ukraine as fast as possible. The situation of stagnant inflation is beginning to gather momentum over Europe, and as a result, the European Central Bank is deciding to take the hits. This has gone ahead to pare the boundaries of a 50 basis points interest rate increase to just 30 basis points as things stand.

Russia-Ukraine Deadlock

On the political side, the peace negotiation between Russia and Ukraine hosted in Ankara for the purpose of a ceasefire ended with no positive resolution on Thursday. The unflinching demand of Russia that Ukraine surrenders is escalating the situation further as Ukraine is not likely, for now, to surrender to Moscow. The continuation of the war is posing greater stress to the Eurozone and its economy.

Investors are watching out for the United Kingdom’s monthly Gross Domestic Product figures as well as Manufacturing Production and Industrial Production for Friday to have a clear direction on what moves to make next. The United Kingdom’s Gross Domestic Product is speculated to print 0.2% higher than the initial prints at -0.2%.

The Euro, on the other hand, is struggling in its paring up with a currency like the US dollar. The pair is recovering for itself after the heat it received from the European Central Bank as it tries to make rounds up to 1.100, up by 0.15% intraday, while the Asian session went on Friday.

The pair’s latest move might be in connection with the confusion in the market about the major risk catalysts and the effects of the US dollar pullback. Even at that, the top currency pair is still on its way to breaking the initial four-week declining trend.