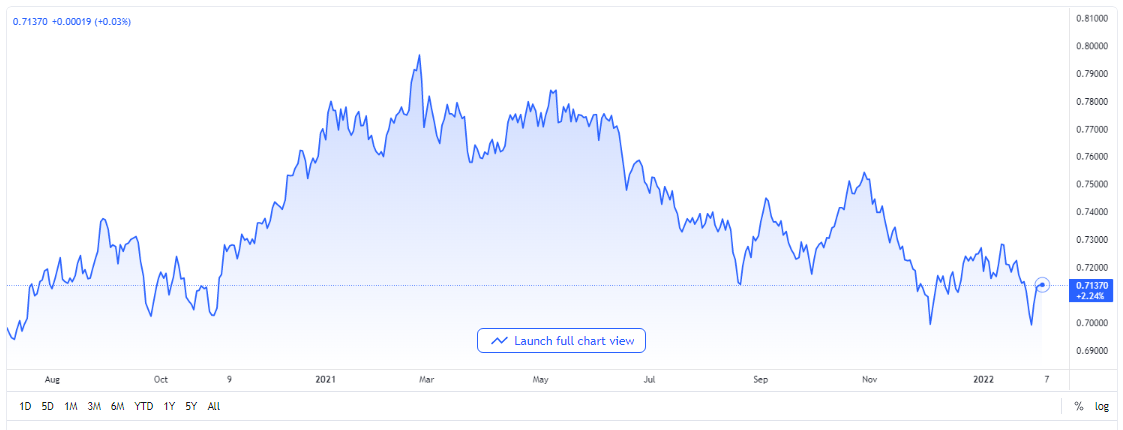

AUD/USD Pair Rise Strongly Above 0.7150 Before the Non-Farm Payroll Report

The Australian dollar (AUD) continued its weekly winning streak on Thursday, and it was trading at 0.7150 at the time of putting this together. Market sentiments are on the low in the equity space while the U.S and European share indicators were printing losses.

The market was, however, trading in a mixed mood. The market’s strongest currency for the day was the Euro, followed closely by the Australian and New Zealand as the Japanese Yen lagged behind in the distance.

The Dollar Index that monitors the progress of the US dollar against a host of other leading fiat currencies dropped 0.44% of its value to land at 95.51. On the flip side, the American Treasury yields rose as the two-year yield reached a daily height of 1.204%, but it later fell back to 1.189% at the time of putting this together.

Macroeconomic Statistics Puts Pressure on the Dollar

The list of economic cases waiting for resolutions in the US includes those of the Institute of Supply Management’s non-manufacturing Purchasing Managers’ Index for last month. It came in at 59.9, being 4/10 over the 59.9 predicted by analysts but follows December’s 62.3 figures.

The Chairman of the Institute of Supply Management’s Service Business Committee, Nieves Anthony, stated that one of the major impacts of the COVID pandemic on the supply chain is the shortage of staff which disrupted operations. He said that respondents are affected by the issues related to the pandemic, such as human capital and capacity, demand-induced inflation, logistic problems, and all manner of shortages.

Unemployment claims for the last week of January were at 238.000, fairer than the 245,000 predicted by analysts and under the number from the previous week at 261,000. The news largely went unattended by the market.

The attention of the AUD/USD pair traders is now fixed on the US NFP report in January still in the pipeline. It is expected at a figure of 199,000. Wednesday’s released ADP statement having companies cut up to 300,000 jobs may be a precursor to the NFP figures expected.

AUD/USD Price Prediction

AUD/USD price chart. Source TradingView

The pair maintain a downtrend bias from a technical point of view. The DMAs are more than the spot prices as the current 50-DMA is at 0.7163. Nonetheless, the latest developments and market pulse could not be overlooked, and it is expected to push the pair upward.