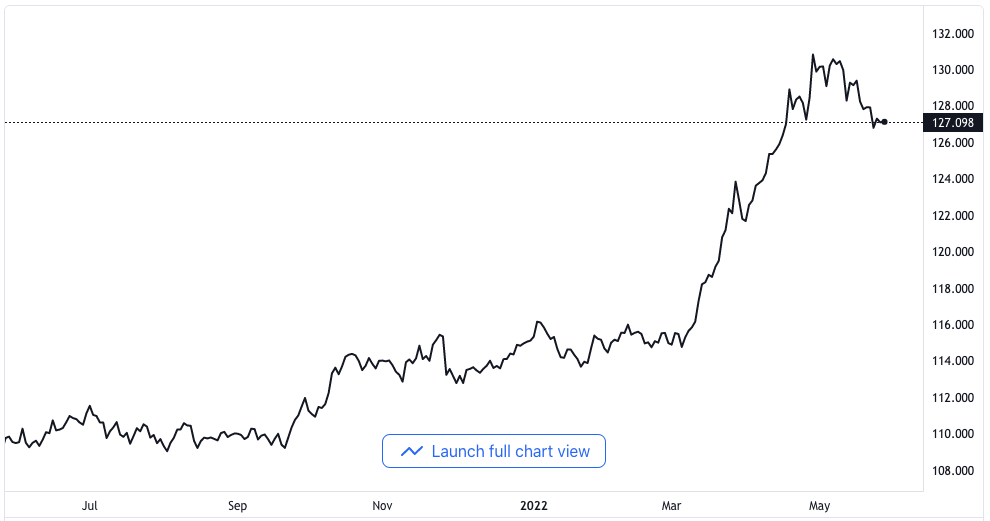

USD/JPY Drop Below 127.00 as Tokyo Has Mixed CPI

Retreats Deeper than Expected

The USD/JPY pair prolongs its retreat of three weeks from a high of many years. This occurs as bearish traders hover around 126.90 and other worries in the Asian session. The latest weakness of the metal might equally be connected to the stronger Tokyo central CPI report.

The weakness might also be connected to the market’s expectation of the Fed’s better inflation measurement. Tokyo’s CPI for this month was reduced by 2.4% year-on-year against the expected 2.7%. it also fell below the initial 2.5% figure.

USD/JPY price chart. Source TradingView

Nevertheless, the CPI from Tokyo, minus food and energy costs rose above the 0.4% market expectation. It also stands tall above the initial 0.8% initial print to arrive at 0.9% year-on-year. The Fresh Food data came in at 1.9% against 2.0% as expected.

Following the Japanese inflation report publication, the BOJ Governor said the central CPI might remain near 2% for a year. Governor Kuroda said this saying except for the price of energy falls drastically.

Kuroda Warns Ahead

The Governor’s speech increased doubts over the BOJ’s soft monetary policy. It also went a long way to strengthen the price of the Yen recently.

On another hand, the American initial quarter one GDP for 2022 dropped to -1.5%. This was under the -1.4% initial figures and the expected -1.3%. But the pending house sales fell to -3.9% in April against -2.0% expected.

Eased reports in the US impacted heavily on the Dollar. Market players equally embraced the absence of a clear part of the Fed’s decision. It shows the guarantee of a 50 basis point rise in rates next two months.

Another factor weighing on the US Dollar is the strong stock markets. We should not also forget the fallen Treasury bond yields.

It should be noted that the fear of a global recession affected risk sentiments. Other conditions include the new COVID cases in China and the war in Ukraine. The tussle between the US and China over Taiwan is yet another factor.

All the aforementioned issues put a lot of pressure on the USD/JPY currency pair. The benchmark on Wall Street equally showed a second consecutive day of gains. But the US ten-year yield is still much indecisive near 2.75%.

Again, the S&P 500 futures began Friday trading with a little loss of close to 4,045. It went down by 0.25% at the minimum.

Going forward, Speeches from the Feds and political news about Ukraine and China are important. They influence near-term trading around the USD/JPY pair.

Beyond that, the central PCE price index for last month in the US will be important. It is expected at 4.9% year-on-year against 5.2% initial.