UK Stocks Record Best Month Of 2022

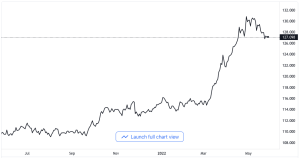

On Friday, the leading equity indexes in Britain enjoyed their best monthly performance of the year.

This was because a series of upbeat corporate earnings from firms like NatWest and a rise in commodities helped in outweighing the worries about an economic slowdown.

Index gains

There was a 1.1% gain in the commodity-heavy FTSE 100 index, while the mid-cap FTSE 250 rose 1.6%, both of which had reached highs of seven weeks.

There was an 8.1% rise in NatWest after the bank gave its full-year forecast a boost and also announced a solid payout for shareholders, which saw the banking index climb by 1.5%.

Market analysts said that the banking sector’s earnings had been benefitting because of the volatile financial markets and the increase in interest rates that have given trading activity a boost.

However, they also said that concerns about financial stocks were also high because the macroeconomic outlook for Britain was shaky for the second half of the year.

This is because of worries about inflation reaching double-digits and worries of an economic recession.

Banking aspects

As far as lenders that have an Asian pivot are concerned, such as HSBC and Standard Chartered, there are also concerns about the draconian zero-tolerance COVID-19 policy of China that has resulted in an economic slowdown.

There was a 0.5% decline in Standard Chartered, even though it recorded a 19% gain in its pre-tax profit in the first half of the year and managed to exceed market expectations.

On Monday, investors were eying results from HSBC, the larger peer of Standard Chartered. All eyes are now focused on the meeting of the Bank of England (BoE) scheduled for next week.

Since inflation has reached a high of four decades, it is expected that the BoE would increase the interest rate by another 25 basis points in its fight against it.

Global market recovery

Nonetheless, this month has seen global markets make a recovery, as sentiment rose due to signs of the US Fed slowing down its aggressive interest rate hiking pace and strong corporate earnings.

The blue-chip FTSE 100 index had recorded its best monthly performance last seen in December 2021, while the midcap index was recording its best month last seen in November 2020.

There was a more than 2.5% rise in oil majors like Shell and BP, while a 2.7% boost was also seen in miners due to firm commodity prices.

A 2.6% fall was recorded in IAG, even though the British Airways owner returned to profitability for the first time after the COVID-19 pandemic broke out, thanks to demand for European flights.

In addition, a 2.4% drop was also seen in Jupiter Fund Management because the half-yearly profit of the asset manager declined.

This was because of increasing outflows, as inflationary pressures and increasing geopolitical tensions caused key global markets to buckle.

In other news, the British pound was once more down against the US dollar, as the latter strengthened, but managed to record gains against the euro.