Stocks Rise For Fifth Session After ECB Rate Hike

A gauge of world stocks climbed for the fifth consecutive session, while the euro climbed up in choppy trading after interest rates were hiked up by the European central bank for the first time in over a decade in order to tame the stubbornly-high inflation.

The ECB’s move

For weeks, the European Central Bank had flagged an interest rate hike of 25 basis points, but earlier this week, some policymakers had stated that it could go bigger. A bond protection plan was also launched by the bank called the Transmission Protection Instrument (TPI), which is aimed at imposing a cap on borrowing costs.

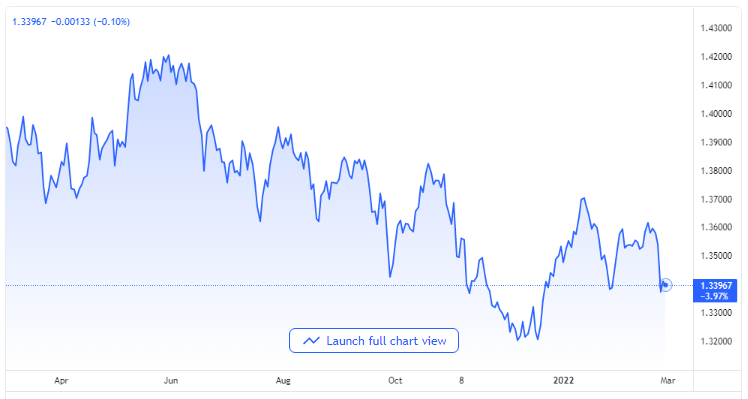

This pushed up the euro to $1.0204, thanks to a 0.27% hike after the common currency had risen as high as $1.0278. As for the US dollar index which measures the currency against a basket of its peers, it recorded a decline of 0.28%.

The aim of the TPI plan from the ECB is to assist countries that are heavily indebted like Italy. The country is also dealing with a great deal of political turmoil currently because of the coalition holding up the government of Prime Minister Mario Draghi fell apart.

Earnings session

Stocks were initially whipsawing between losses and gains before they recorded traction. The drop in crude prices pushed the energy sector lower, but US equities got a boost from Tesla’s impressive quarterly earnings that sent up its shares by 9.78%. Indexes got a lift due to the outperformance recorded in growth shares.

The US earnings season is moving along with 91 companies that are part of the S&P 500 index having reported their quarterly results already. According to data from Refinitiv, about 78% of these companies have already managed to post better-than-expected results. This is slightly lower than the 81% rate recorded in the last four quarters, but better than 1994 when the rate stood at 66%.

Market analysts said that earnings had been a big concern and expectations had been quite low. While it is still too early to draw conclusions, things appear to be well in terms of corporate earnings.

Index performance and data

The Dow Jones Industrial Average got a boost of 0.51%, which saw it add 162.06 points to reach 32,036.9. The Nasdaq Composite also advanced by 1.36% to add 161.96 points and end at 12,059.61. There was also a 0.99% rise in the S&P 500 index that moved up by 39.16 points to 3,999.06.

The economic data in the US was a tad soft, as weekly jobless claims reached a high of eight months and a factory activity gauge for July also came down to its lowest in two years. This data comes ahead of the monetary policy meeting of the Federal Reserve in the next week, where it is expected to announce another rate hike of 75 basis points.

Europe’s STOXX 600 index also recorded gains of 0.44% and there was a 0.77% gain in the MSCI’s gauge of global stocks. Oil prices also recorded declines for the second session in a row.